Understanding the Fortnightly Tax Table is crucial for Australian business owners and employers to ensure accurate tax withholding from employee salaries. This comprehensive guide will provide you with the latest tax table for Fortnightly 2024-2025, including ATO tax table codes, and step-by-step instructions on how to use it effectively.

Contents

Fortnightly Tax Table 2024-2025

What is the Fortnightly Tax Table?

The tax table for Fortnightly, issued by the Australian Taxation Office (ATO), is a critical tool for employers to calculate the amount of tax that needs to be withheld from employee earnings. This table is designed to cater to different payment frequencies, including weekly, fortnightly, and monthly payments.

Tax Table For Fortnightly 2024

Business owners in Australia are required to withhold tax from the remuneration they pay to employees or contractors. This withheld amount is sent to the ATO to cover the employee’s end-of-year tax obligations. Payments to employees can be made on various schedules, including every seven days, fourteen days, or thirty days. The ATO provides an online tax calculator for precise calculations based on employee details.

Tax Table For 2025

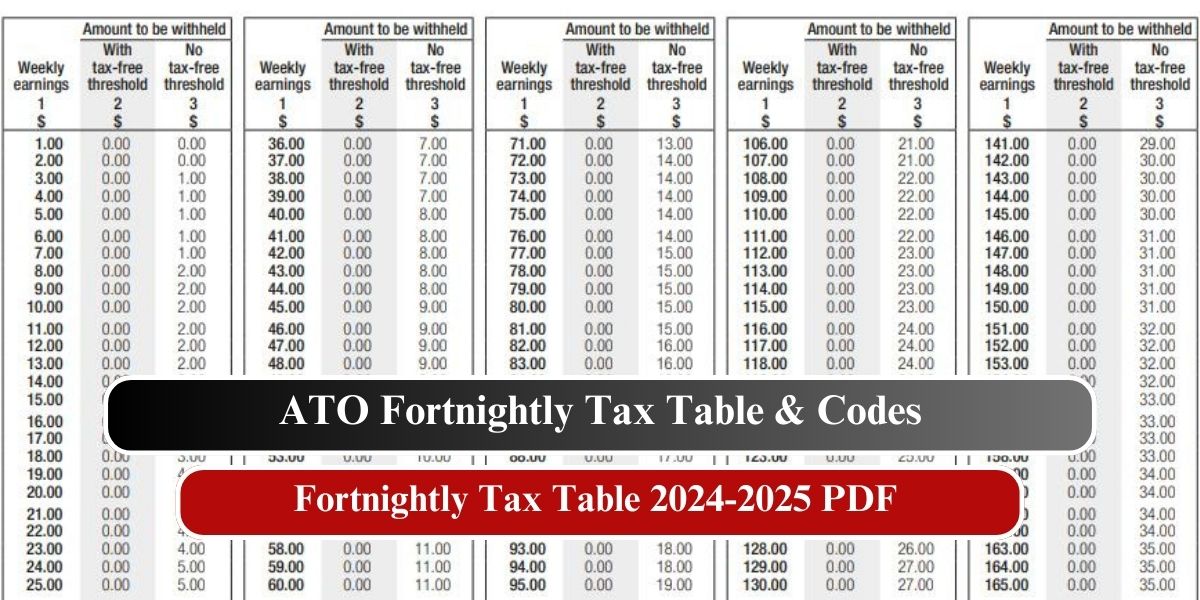

The amount withheld varies depending on whether the employee has opted for the tax-free threshold. Below is a snapshot of the Fortnightly Tax Table for 2025:

| Earning | Tax-Free Threshold | No Tax-Free Threshold |

|---|---|---|

| $100 | $0 | $18 |

| $300 | $0 | $62 |

| $500 | $0 | $110 |

| $724 | $2 | $162 |

| $1000 | $66 | $224 |

| $2000 | $324 | $566 |

| $3000 | $670 | $912 |

| $5000 | $1378 | $1650 |

| $6550 | $1982 | $2282 |

Employers should use this table to determine the correct amount to withhold from employee wages.

Tax Table For Codes

For earnings between $6550 and $6922 with the tax-free threshold, the amount to be withheld is $1982 plus thirty-nine cents for each dollar earned over $6550. For earnings exceeding $6922, withhold $2182 plus forty-seven cents per dollar above the threshold.

If the employee does not opt for the tax-free threshold and earns more than $6550, the withholding amount is $2282 plus forty-seven cents for each dollar above $6550.

How to Use the Fortnightly Tax Table

Follow these steps to ensure accurate tax withholding:

- Calculate Gross Remuneration: Include bonuses and any additional amounts beyond the fixed salary.

- Determine Deductions: Based on whether the employee has opted for the tax-free threshold, refer to the corresponding amount in the tax table.

- Select the Correct Table: Use the Tax Table For Fortnightly for calculations.

- Find Taxable Income: Locate the gross remuneration in the tax table.

- Calculate Withholding Tax: The tax amount listed will be deducted from the gross remuneration.

Ensure that calculations are based on full-year employment. For part-year employment, adjust the withholding amount accordingly.

How to Download the Fortnightly Tax Table 2024-2025 PDF

To download the Fortnightly Tax Table PDF, follow these steps:

- Open a compatible web browser.

- Visit the Australian Taxation Office (ATO) website.

- Navigate to the ‘Tax Professionals’ tab on the main menu.

- Select ‘Tax Rates & Codes’ under the ‘Key Links’ section.

- Find the link for ‘Fortnightly Tax Table’ and click on it.

- On the next page, locate and tap on the PDF link for the tax table.

Accessing and utilizing the tax table for Fortnightly ensures compliance with tax regulations and helps in precise payroll management.