Learn about the OAS Increase 2024 and the expected CPP and OAS adjustments for 2024 in detail from this article. It contains comprehensive analysis and essential information on these updates.

Contents

OAS Increase 2024

The Old Age Security (OAS) is a prominent pension plan managed by the Canadian Government, providing monthly payments to eligible individuals aged 65 and above.

Applicants must apply for OAS manually if sufficient information is not already on file with the authorities. The OAS Clawback threshold is projected to rise in 2024, increasing from $86,912 to $90,997. Further details on the OAS Increase in 2024 can be found on the official CRA website.

OAS Expected Increase 2024

| Name | Old Age Security |

| Country | Canada |

| Administered by | Government of Canada |

| Type | Pension Plan |

| Age Requirement | 65 or older |

| Current Maximum Payment | 707.68 dollars (age 65 to 74) | 778.45 (age 75 or older) |

| Payment Dates | November 28, 2023 | December 20, 2023 |

| For more information | canada.ca |

How Much will CPP and OAS Increase in 2024?

On November 1, 2023, the Canada Revenue Agency (CRA) announced updated contribution rates and amounts for 2024. The maximum pensionable earnings under CPP will rise to $68,500 from the current limit of $66,600 in 2023.

The basic exemption limit will remain unchanged at $3,500. Additionally, a second earnings ceiling of $73,200 will be introduced for determining CPP 2 Contributions.

As a result of this change, earnings between $68,500 and $73,200 will now be subject to CPP 2 contributions. The adjustment to the ceiling aligns with CPP legislation.

CPP is a retirement pension plan that offers monthly payments to eligible Canadians. To qualify, individuals must be at least 60 years old and have made at least one CPP contribution. Unlike OAS, application is required to receive CPP benefits.

The CPP pension amount is calculated based on lifetime average earnings, starting age, and contributions made to CPP. Every Canadian aged 18 and above who works is obligated to make CPP contributions. These contributions enable eligibility for disability benefits, pensions, post-retirement benefits, and survivor benefits.

Contributions to the CPP cease once a person reaches 70 years of age, regardless of whether they are employed or not. The contribution amount is based on income and is calculated on annual earnings within specified maximum and minimum thresholds.

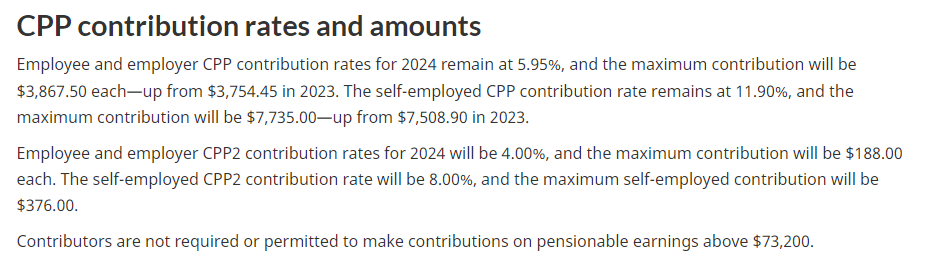

In 2024, the contribution rate for both employers and employees will remain at 5.95%. However, the maximum contribution limit for each will increase to $3,867.50, up from $3,754.45 in 2023.

Likewise, self-employed individuals will continue to contribute at a rate of 11.90%. Their maximum contribution limit will rise to $7,735, compared to $7,508.90 in 2023. It’s important to note that contributions cannot be made on pensionable income exceeding $73,300.

Employers and employees will contribute 4% each towards CPP 2 contributions, with a maximum contribution limit of $188 for each party. Self-employed individuals will contribute 8% towards CPP 2, with their maximum contribution limit set at $376.

Detailed Analysis of CPP and OAS Increase

Contributions to the CPP are crucial as they significantly influence eligibility for benefits for individuals and their families. Typically, higher earnings and contributions to the CPP before retirement result in increased benefits.

Since 2019, the CPP has undergone enhancements. Workers who make valid contributions to the CPP will receive augmented benefits upon retirement in the future. However, these enhancements apply only to those who contribute to the CPP from 2019 onwards.

As of 2023, the current maximum payments and income thresholds for the OAS are as follows:

| Age | Max Monthly Payment | Annual net world income (2022) |

| 65 – 74 | 707.68 dollars | less than 134,626 dollars |

| 75 and over | 778.45 dollars | less than 137,331 dollars |

The OAS undergoes periodic reviews, typically four times, to adjust for increases in the cost of living. The monthly payment amount remains unchanged even if the cost of living decreases.

Beginning July 2022, individuals aged 75 or older automatically receive a 10% increase in their OAS. Those who turn 75 after July 1, 2022, will see their OAS increase the month following their birthday.

If someone’s income exceeds $86,912 (2022), they may be required to repay a portion or the entire OAS pension. This threshold will increase to $90,997 in 2024, according to available information.